Galibier’s investment philosophy is driven by an unwavering belief in valuation driven, bottom-up stock selection. Central to Galibier’s investment approach is the belief that prices in equity markets often do not reflect the true, or intrinsic, value of a company. As a firm dedicated to fundamental research, our strategy is to proactively evaluate our defined investable universe of stocks through a rational and rigorous research process and to identify those opportunities where a stock is trading below its calculated intrinsic value.

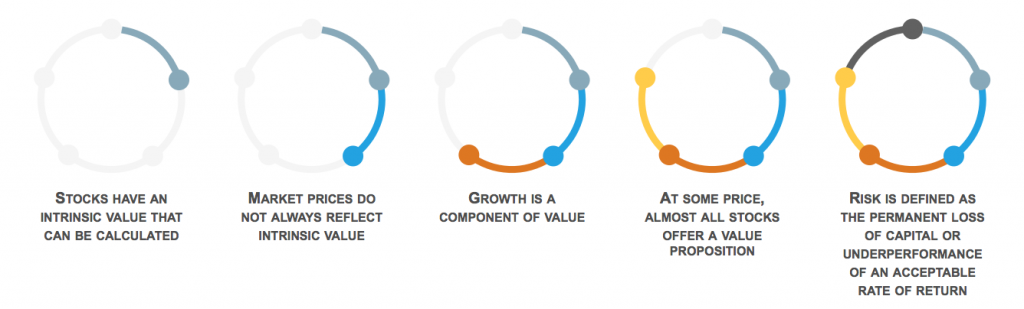

The investment process is driven from our fundamental beliefs that:

Galibier’s underlying competitive strength comes from the fact that it is an employee-owned investment-driven organization where the employees’ interests are completely aligned with clients’ interests due to significant personal investments in the products that we manage. We also employ a long-term investment horizon that enables us to take advantage of opportunities that other managers with a shorter time horizon may not be able to.